NEW FEATURES IN pROCOUNTOR VERSION 40.0

Version 40.0 of Procountor was published on Saturday, May 16th.

Read more about the upcoming changes below.

- Approval circulation

- Bank statements and reference payments

- Reconciliation tools

- Holiday calculation

- Other improvements and fixes

Renewed Procountor Mini

A new version of Procountor Mini mobile app will also be released. This version includes new receipt handling features. Read more about the new features below.

Approval circulation

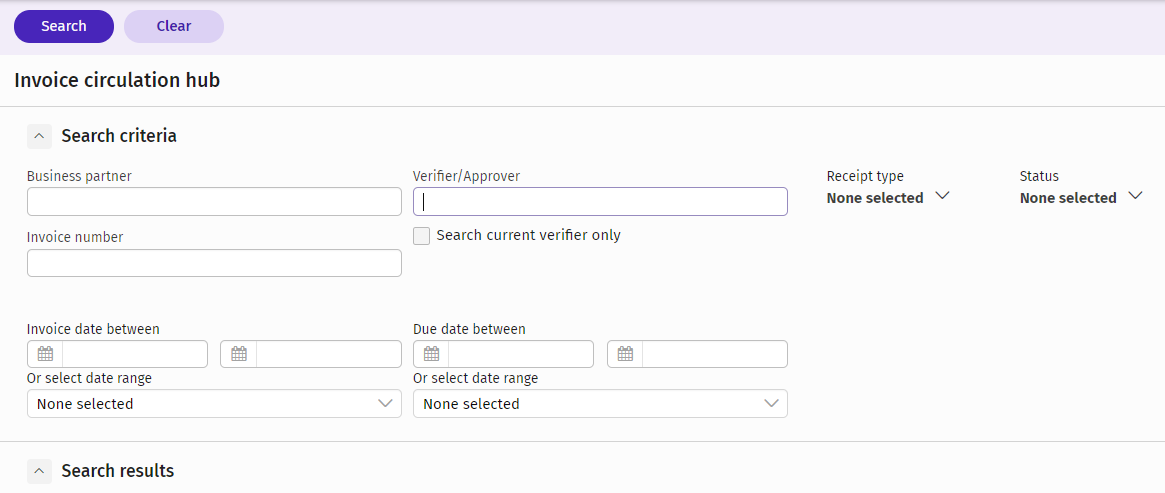

A new search criterion for invoices in circulation

We have released a new search criterion on the Invoice circulation hub view. It is now possible to search invoices on the view by using the verifier / approver person's name as a search criterion. Purpose of the additional search criterion is to make it easier for users to filter invoices on the view.

Find the new feature from the "Search criteria" panel in the Invoice circulation hub. When typing a name of a person to the "Verifier/Approver" field, all invoices where this person is part of the invoice's circulation process will be listed to the search results. When selecting the additional selection "Search current verifier only", just those invoices are shown where the user used in the search is the current verifier or approver.

Bank statements and reference payments

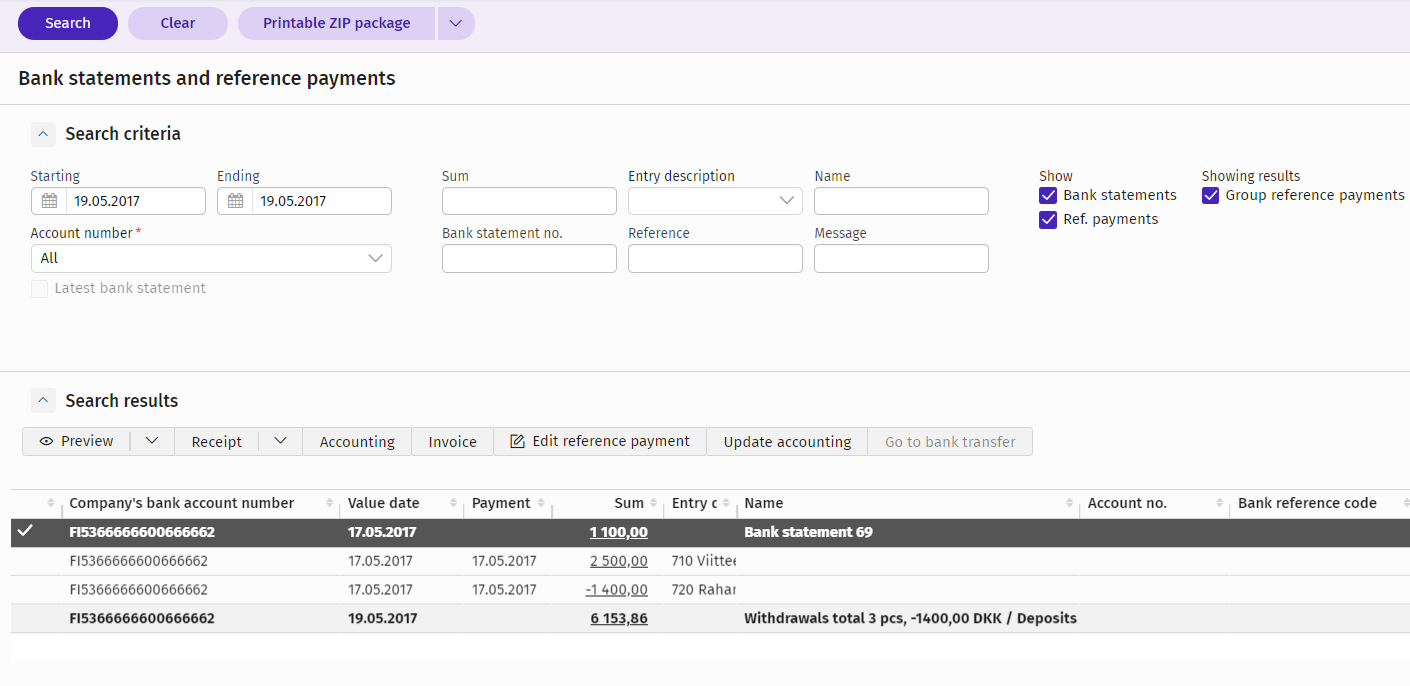

Renewed Bank statements and reference payments view

The Bank statements and reference payments view has been renewed. Search criteria have been rearranged to save space. The "Show detailed search" option has been removed as all the search criteria are now visible by default.

The search results table has been updated to function better with a big amount of rows. The readability of the search results has been improved e.g. by better contrast.

Reconciliation tools

The updated Account Inspection Report: Accounts and Transactions

The Account Inspection Report has been renamed as Accounts and Transactions. We have made changes to the tool to better support working with it on a daily basis. The default positioning of the tables has been updated and going through accounts has been simplified. We have also changed the summary section so that detecting any changes in VAT and receipts unreconciled does not require action.

Some of the old buttons (such as All accounts, All transactions etc.) have been removed since the functions can now be performed without them, e.g. all accounts can be chosen at once by clicking on the checkbox in the top row of the accounts table.

Improvements to The Reconciliation Report for Open Invoices

The Reconciliation Report for Open Invoices has been updated to better support daily work. The search criteria are presented in a clearer way and ledger accounts are shown on the view. The table component has been improved. Date rows which contain a difference are highlighted in yellow and both Difference and Change values are emphasized. In addition, there are separate buttons available for default date search and search from start of the financial year on the top of view.

Holiday calculation

Paying holiday bonuses

Holiday bonus can be paid the same way as normal salary slips. After creating a salary slip, the holiday bonus row can be added by clicking the Holiday pay button.

A new salary type Holiday bonus (automatic calcul. 2233) has been created and is used to pay holiday bonus with all holiday calculation bases when using the holiday bonus functionality.

After the Holiday bonus salary type has been selected, the system will suggest a holiday pay calculation basis (set on the Employee’s Holidays view) and amount of available holiday bonus days. A holiday bonus salary row is created to the salary slip after the number of holiday bonus days are set and Add to slip button has been pressed.

Currently it is not possible use different calculation bases on the same salary slip. For example, if the employee has the percentage calculation basis in 2018-2019 holiday credit year and then monthly with standard divider in 2019-2020, the holiday pay and holiday bonus needs to be paid with separate salary slips with one calculation basis per salary slip. Further development is due in near future for this feature.

Additional leave days and additional leave day compensation

Salary type 2234 Additional leave day compensation was added to the salary type register in our earlier release for non-holiday pay functionality users. Now Additional leave day functionality has been released for holiday pay functionality users.

When an employee has earned less than 24 holiday days due to sickness or rehabilitation, it is now possible to add additional leave days for an employee in their holiday tab behind Edit yearly figures.

Currently there is no automated determination for the value of additional leave days, the estimation can be given in the top section of the holiday tab in Estimated daily compensation for additional leave days (EUR). This value is used in holiday accrual report as well as in salary slips. The value can be changed later in the holiday tab and/or salary slips.

The estimated value can always be updated to be the latest, thus it is in the top section of the employees Holiday tab. When paying the additional leave day compensation, pick it behind the Holiday pay button. In case you want to pay other holiday pay at the same time, pick the Additional leave day compensation first, this leaves the Holiday pay button active. Remember to check the daily compensation value and update it in the salary slip if needed.

Fixes and improvements

General usability

- Drop down menus that show the current location have been updated visually to improve their readability. These are the Go To button menu (on invoice/receipt views) and Basics menu (opened from the top-right corner of Procountor).

- Newer table types have been updated to enable selection of multiple rows using keyboard commands together with mouse. The check boxes can now also be used to select a range of rows using Shift key. For Mac users, the Command key works in selecting multiple and out of a range rows.

Invoice circulation

- Table for the Verification of Multiple Invoices has been updated to handle large amounts of data better. View can be accessed in the Verification drop down menu in Receipt Search.

Consumer e-invoices

- In our previous release, we added a possibility to add existing consumer e-invoice sender info notifications to Procountor. We have modified the logic so that users can view, change or delete the notification immediately after saving it. However, when new sender info notifications are created and sent to the bank, a two-day rule prevents modifying the notification, as before.

Closing of accounts tools

- In the closing of accounts tools there was an error that prevented adding decimals to the "Sum (previous financial period)" field of the income statement. This has now been fixed and it is possible to add decimals on the income statement as well.

Salaries and notifications

- A new default value has been added to the Earnings payment report, so that it will show results from the last couple of months. This makes the report faster to open.

- Gross recovery is now taken into account in the sum of salaries paid during year in Management > Salary info > Salaries basic info. Now gross recovery acts the same way as net recovery when concerning the calculations of the company's yearly paid sums. On a salary slip with gross recovery, the tax and the side costs are calculated in same way than before i.e. recovery row does not reduce the sum from which the tax and side costs are calculated. Gross salary sum in salary slip is not the sum from which the tax and side costs are calculated because gross salary sum is taken into account also in the recovery row.

- A new Recalculate button has been added next to the sum of salaries paid during year in Management > Salary info > Salaries basic info. The salaries paid during year field is automatically monitored by Procountor based on the salary payments made by the company in total. The recalculate button recalculates the sum, taking into account certain situations that have not TOISTAISEKSI been included automatically. These situations were gross recovery situations (fixed in this update, see the previous bullet point) and situations where a user has never entered the Salaries basic info view and a database row has not been created. In practice, it is advisable to use the recalculate function when the salary sum is close to the limit of 2 125 500€ yearly salaries. The salary total affects the payment percentages of unemployment insurance payments. Under 2 125 500€ yearly salaries will use 0,45% and over 2 125 500€ yearly salaries will use 1,70%.

Procountor Mini

We are combining the functions of our mobile apps in one mobile app. You can now ind the receipt handling functions from Procountor Receipts also in our Procountor Mini app. You can test the first receipt handling features in Mini by downloading the newest version of Mini around 16th of May. The new version can be uploaded from the app store free of charge.

As a part of this renewal we have also released several new features and improvements to receipt handling:

- Support for receipts with several pages

- Changing currencies

- Editing the receipt information in Procountor

- Sending PDF receipts

- Adding long additional information texts

- Support for several VAT rates in the same receipt

The testing phase of the new receipt handling features is free for all users. Procountor Receipts app will function normally beside Procountor Mini until further notice.

The receipt handling features can be used by both the Financials and Ledger users. Ledger users cannot however create travel or expense invoices from receipts.

Development ideas? Other feedback?

We will continue developing the receipt handling features of Mini based on customer feedback. We would be pleased to hear about your experiences and possible development suggestions. You can contact our customer service by phone

(+358 20 7879 840 (mon-thu 8.30 am – 4 pm, fri 8.30 am –2 pm) or by mail asiakaspalvelu@procountor.com. Thank you!

New receipt handling functions

- Taking pictures of receipts or creating reeipts from existint picture files

- Support for receipts with multiple pages

- Typing product and purchase information for new receipts

- Adding multiple products in one receipt. The products can have different VAT rates etc.

- Saving receipts. Saved receipts will appear in Procountor (browser version)

- Browsing receipts and their statuses in Mini

- Once a receipt is handled (an invoice has been created), a check mark will appear next to the receipt in Mini

- Browsing receipts in Procountor. Users with the "personnel" user rights will only see their own receipts, however users with broader user rights can see more receipts.

- All receipts (pictures with both Mini and Receipts app) are available in the same New receipts widget on Procountor's frontpage. This widget display new/unhandled receipts.

- Editing the information of receipts in Procountor

- Receipts can also be searched in Procountor in Search > Cost receipt management. By default, unhandled receipts are searched, however handled receipts can also be searched by changing the search criteria.

- Travel and expense invoices can be created from both the New receipts widget and the Cost receipt management view.

- The new invoice will automatically include product rows based on the receipt information and the receipt picture will be found in its attachments.

- Once the invoice is saved, the receipt status is updated to Handled.

- In case the invoice is invalidated, the receipt attached to it will return to Unhandled status.